Develop your personal financial plan. Learn to invest. Put a tick behind your retirement savings. With the finmarie Academy, you’ll learn everything you need to know about money to get started.

As seen in

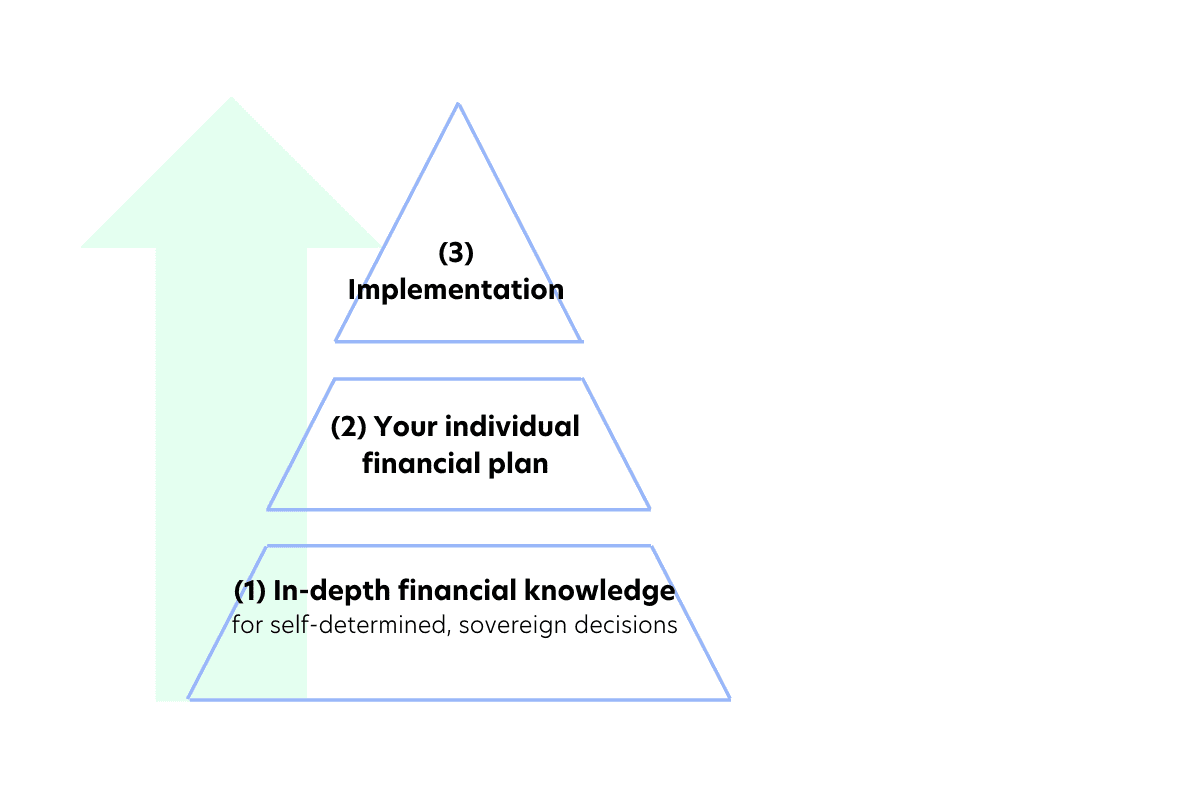

Learn everything you need to know about money and investing – explained simply and compactly, directly applicable, without fear of doing something wrong.

Finally cross the topic off your to-do list and enjoy the relief of having your finances under control with a solid strategy for the future.

Build up passive income step by step and become independent – no matter if from your job or your partner.

"I've avoided the topics of investing and retirement planning for a long time, and subconsciously it was stressing me out. As a test user, I've completely revamped my finances over the last few weeks with the help of finmarie Academy and set up a system for myself where I automatically invest a certain amount every month. I never imagined how much more relaxed I am overall now that I have the peace of mind that I am financially well positioned for the future..."

Alexandra F.

Easy-to-understand, compact online modules and video courses on the really relevant topics

Concrete step-by-step instructions, workbooks and tools for your implementation

Regular live coaching sessions with experienced female financial experts who will address your questions

With the finmarie Academy you benefit from years of financial expertise and proven strategies for wealth accumulation!

✓ you have full transparency about your financial situation

✓ you know how big your pension gap will be and how you can close it

✓ you know your financial goals and have a customized plan with concrete, easy-to-implement steps to achieve them

✓ you have learned how to invest your money easily and conveniently – without the fear of doing something wrong or wasting a lot of time

✓ you feel the relief of having your finances under control and your future finanical independence underway

Introduction & Money Mindset Critical foundations and how to improve your financial mindset.

Together we bring structure to your finances!

Inventory, goals and the budget levers. How to optimize your income and expenses.

The most important basics of investing

How do you invest in the stock market? What asset classes are there and which are relevant for you?

The most important points about Stocks, Funds, ETFs, Bonds and Commodities:

The most important advantages and disadvantages, and what you should pay attention to.

Critical facts about real estate, crypto and business angel investments

The main pros and cons, and what you should definitely look out for.

Implementation!

We show you step by step how to craft your own strategy and portfolio, and how to choose the right investment products.

Insurances

Which insurance do you really need, and how can you save money? What should you look for?

Keep at it!

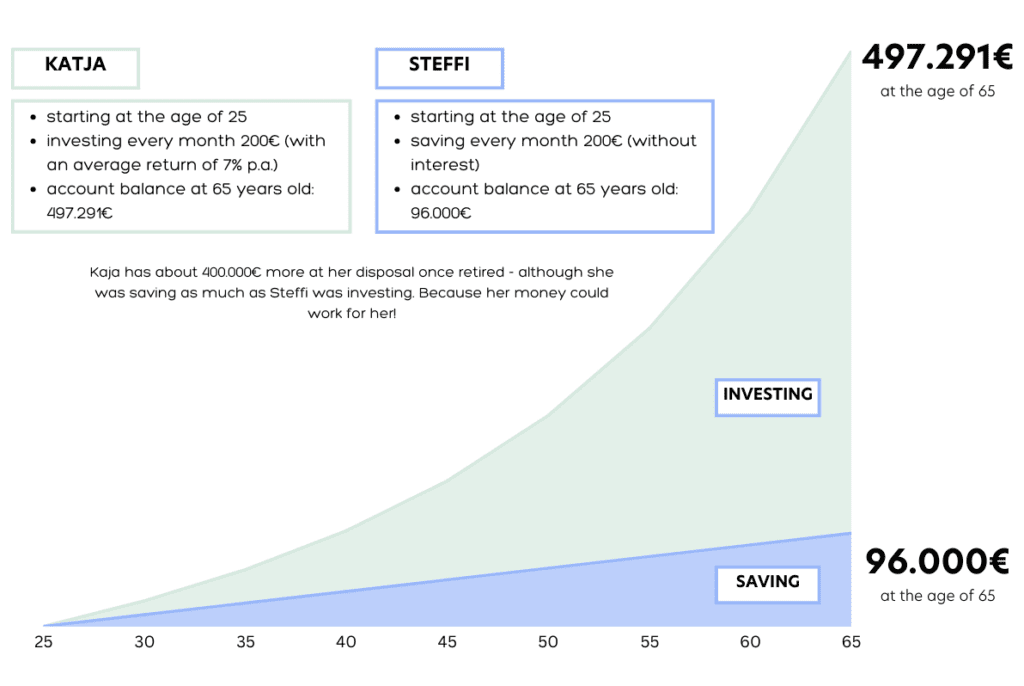

How to make your money work for you long-term without a lot of effort.

As a member of the finmarie Academy you have access to many practical tools and templates – so you can get started right away!

✓ Financial checklist

✓ Template Budget Planner & Budget Book

✓ Financial Freedom Calculator

✓ Portfolio Examples

… only want to deal with the topic of finances once and then check it off your list

… want to benefit from tried and tested strategies, avoiding mistakes and months of research

… want to have experienced financial experts by your side to support you on your way to financial independence.

Simply arrange a 15min Zoom Meeting with us to get to know each other, 100% without obligation and free of charge.

Yes, we make special notes about what situations are particular to Germany and which ones may apply to you if you live in other countries, so you can participate in the finmarie Investment Academy from abroad as well. We want to offer as many women as possible the opportunity to learn to invest through our course.

If you are already highly advanced, have a solid investment strategy, are well-versed in various investment vehicles, and already have a well-established portfolio, we would not recommend the finmarie Investment Academy for you. If you still want to make some changes or seek expert advice, you might find more value in our personalized finmarie Financial Coaching.

We also want you to benefit from the finmarie Investment Academy immediately. Therefore, we consider it unprofessional to recommend a course for learning investment if you have high consumer debts.

If your goal is simply to get rich quickly, then this program is also not appropriate for you. Our focus is on holistic wealth-building for women with long-term success, and we want you to understand your finances from the ground up.

You have access to all the content for 12 months.

The time required can vary somewhat depending on the week and topic. Generally, you should plan for about 1 to 2.5 hours per week. The finmarie Investment Academy consists of video courses that you can watch at your own pace, tasks, and also live Q&A sessions with our financial experts.

We offer various options, usually once during the lunch break at 12:00 PM and once after work at 7:00 PM.

Yes, you don’t need to have large sums of money. Even investing smaller amounts, such as 25 euros, is sufficient. We provide you with a step-by-step guide so that you understand what your personal next steps are.

Yes, we have intentionally structured the Investment Academy in a way that beginners without any prior knowledge are gradually introduced to financial topics. Our comprehensive program is designed so that within 8 weeks, you will become a successful investor who can take control of her finances independently. This means you will learn to improve your overall relationship with money, learn effective saving tips, and learn from our experts about the details of the market and how wealth-building actually works. We will teach you how to invest in stocks, what ETFs and cryptocurrencies are, and the role insurance, commodities, and real estate investments play today. It’s all about going from “zero to hero”!

The finmarie Investment Academy goes deep into the different types of stocks and bonds that exist and also their advantages, disadvantages and the role they play in your portfolio, all with the aim that you become a successful investor within 8 weeks. We not only explain how to invest in stocks or ETFs but also introduce you to other asset classes such as bonds, cryptocurrencies, commodities and real estate. We aim to provide you with a solid overview. Afterward, you can decide based on your goals and preferences which asset classes you want to invest in. If you already have a portfolio, the Academy can help you optimize it and tailor it to your personal situation. If you don’t have one yet, our information will assist you in building and discovering your personal investment strategy.

You don’t need to purchase anything beforehand; just have a laptop/computer or a smartphone/tablet ready. Make sure you have a good internet connection and enough battery before you get started :)!

No problem, you can mostly complete the finmarie Investment Academy at your own pace. You can watch the video courses and complete the various exercises whenever it suits you. Only the live coaching sessions with our financial experts are scheduled for specific dates.

We place a lot of emphasis on making sure that you are well-equipped and ready to take action after eight weeks. We offer as much concrete support as possible. We also provide live coaching sessions in selected groups where you can ask any questions you have about the Investment Academy.

Money is one of the biggest stress factors for employees. Therefore, it is definitely in your employer’s interest to support you in your financial education. Asking questions is worthwhile, for example, when discussing further education or potential special benefits like coaching with your supervisor.

When reserving multiple seats for corporate clients, we may provide discounts based on the quantity booked.